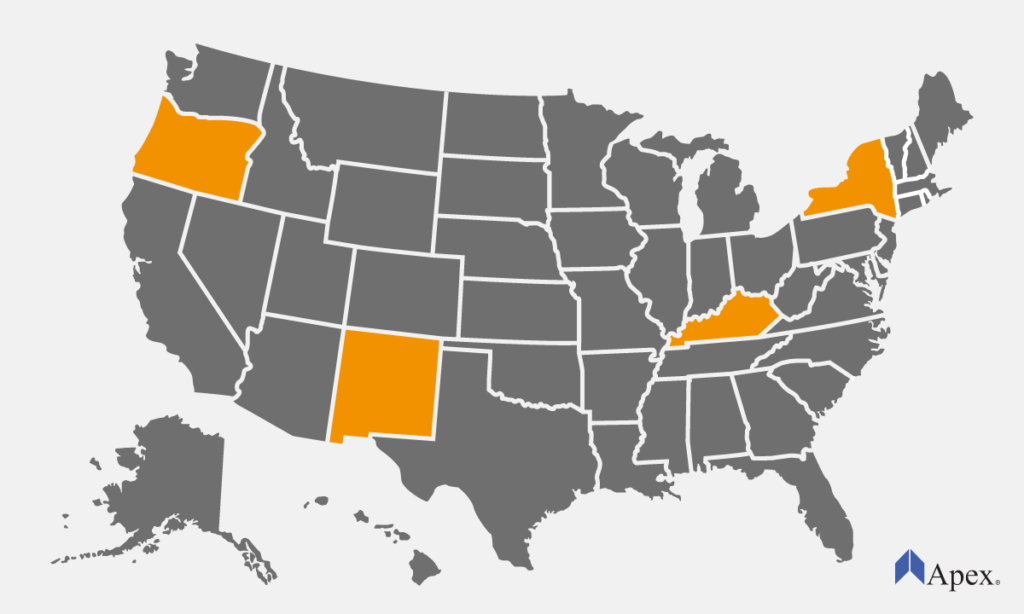

Truckers that plan to haul through Kentucky, New Mexico, New York, or Oregon are required to have specific weight distance permits.

Trucks hauling heavy loads across America’s highways cause wear and tear on roads. To counterbalance that damage there are four states that require trucking companies to pay additional weight distance taxes to haul within their state lines. These additional taxes are used to keep their roads smooth and safe.

If you’re planning to have New York, New Mexico, Kentucky or Oregon in your trucking company’s regular route, you’ll likely want to complete these additional registration processes.

Weight Distance Taxes and Permits

New York Highway Use Tax

New York imposes a Highway Use Tax (HUT) on any motor carrier using New York highways with a gross vehicle weight over 18,000 pounds. These carriers are required to register and obtain a New York HUT certificate and decal. To register, fill out Form TMT-1 or use their online registration system.

Highway use tax returns may be filed either by mail or online.

If you plan on only traveling through New York occasionally you can get a trip certificate of registration for a $25 fee. This trip permit allows you to operate in New York State for three days after the date it was issued. The permit will expire on midnight of the third day.

New Mexico Weight Distance Tax

If you’re hauling within or through New Mexico and operate a vehicle with a gross vehicle weight over 26,000 pounds, you’ll need to register and pay the New Mexico Weight Distance Tax. Every quarter you’ll need to file and pay the appropriate taxes to the New Mexico Motor Vehicle Division, which can be done electronically at tap.state.nm.us.

New Mexico also provides temporary permits for those who need to haul within or through the state. Their trip permit must be obtained at a port of entry either before or when you cross state lines. The temporary trip permit is valid for 72 hours and the fee will be determined by your mileage and vehicle weight.

Kentucky Highway Use Tax or KYU

Any carrier traveling through Kentucky with a declared vehicle weight equal to or greater than 59,999 pounds is required to register for the Kentucky Highway Use Tax (KYU). Registration can be completed online or by mail at drive.ky.gov. It’s suggested that you file online which provides an immediate KYU Number upon completion, whereas mailing your KYU application can take 10-14 business days to process. Quarterly tax filings will be completed online by registering for the KYU E-File Application.

Kentucky allows carriers to purchase one-time temporary KYU permits if you need to make irregular trips through the state.

Oregon Weight-Mile Tax

Hauling through Oregon with a commercial vehicle having a combined weight of 26,000 pounds or more, will require payment to the Oregon Weight-Mile Tax. You’ll need to fill out the Oregon Weight Receipt and Tax Identifier (OWRATI) application and mail to the Oregon Department of Transportation, Motor Carrier Transportation Division. You’ll also be required to file a Highway Use Tax Bond with the Oregon Department of Transportation starting at $2,000 for one vehicle. Most motor carriers are required to report mileage tax on a monthly basis by the last day of the following month. You can access online services at https://www.oregontruckingonline.com/.

Oregon does supply temporary passes to those planning to haul within Oregon sporadically, but will only allow a maximum of five temporary passes in a 12-month period. Fees vary.

Weight Distance Tax Filing Process

The amount of your weight distance taxes will typically depend on your truck’s weight and how many miles you traveled in each specific state. You’ll already have the miles traveled in each state reflected in your quarterly IFTA filing. Generally, taxes are due on the last day of the month following the end of the quarter.

- Q1 (January-March): April 30

- Q2 (April-June): July 31

- Q3 (July-September): October 31

- Q4 (October-December): January 31

Apex Can Help

Do you want to start a trucking company but the process seems confusing? Let the transportation specialists from the Apex Startup Program guide you through the process of getting your own authority. We’re with you every step of the way as we help you form a business entity (LLC) in your home state. We complete and file all the paperwork for you and also send you a Record Book with the important documents you’ll need to run your trucking company.

If you want to start your own trucking company, give us a call at 855-369-2739 to learn more about how the Apex Startup Program can help make the process fast and easy. To learn more about what to expect in your first year of trucking, download our free white paper and subscribe to our channel on YouTube.