Meet the Apex Fuel Card for Truckers: your ticket to big savings on diesel fuel expenses.

We get it – managing costs as a trucking company can be tough, especially when it comes to fuel. That’s why we’ve teamed up with TransConnect Services (TCS) to offer one of the best fuel cards designed just for truckers like you. With the Apex TCS Fuel Card, you’ll get big discounts and handy tools to find the best fuel prices across the USA and Canada. Say goodbye to high fuel costs and hello to saving more with the Apex Fuel Card for Truckers.

What are Fuel Cards For Trucking Companies?

Fuel cards for truckers are special cards that help truck drivers save money on diesel fuel. When drivers use the Apex Fuel Card at an in-network truck stop, they will get great fuel discounts and $0 transaction fees on fuel purchases. These cards also make it easier for trucking companies to track and manage their fuel expenses. So, fuel cards for truckers help save money on fuel and keep track of spending.

With the Apex fuel cards, you can:

- Track fuel purchases across your fleet in real-time.

- Set spending limits for fuel and other products

- Get discounts on diesel fuel at more than 1,800 in-network locations.

- Never pay more than cash price for fuel

- Streamlined International Fuel Tax Agreement (IFTA) reporting.

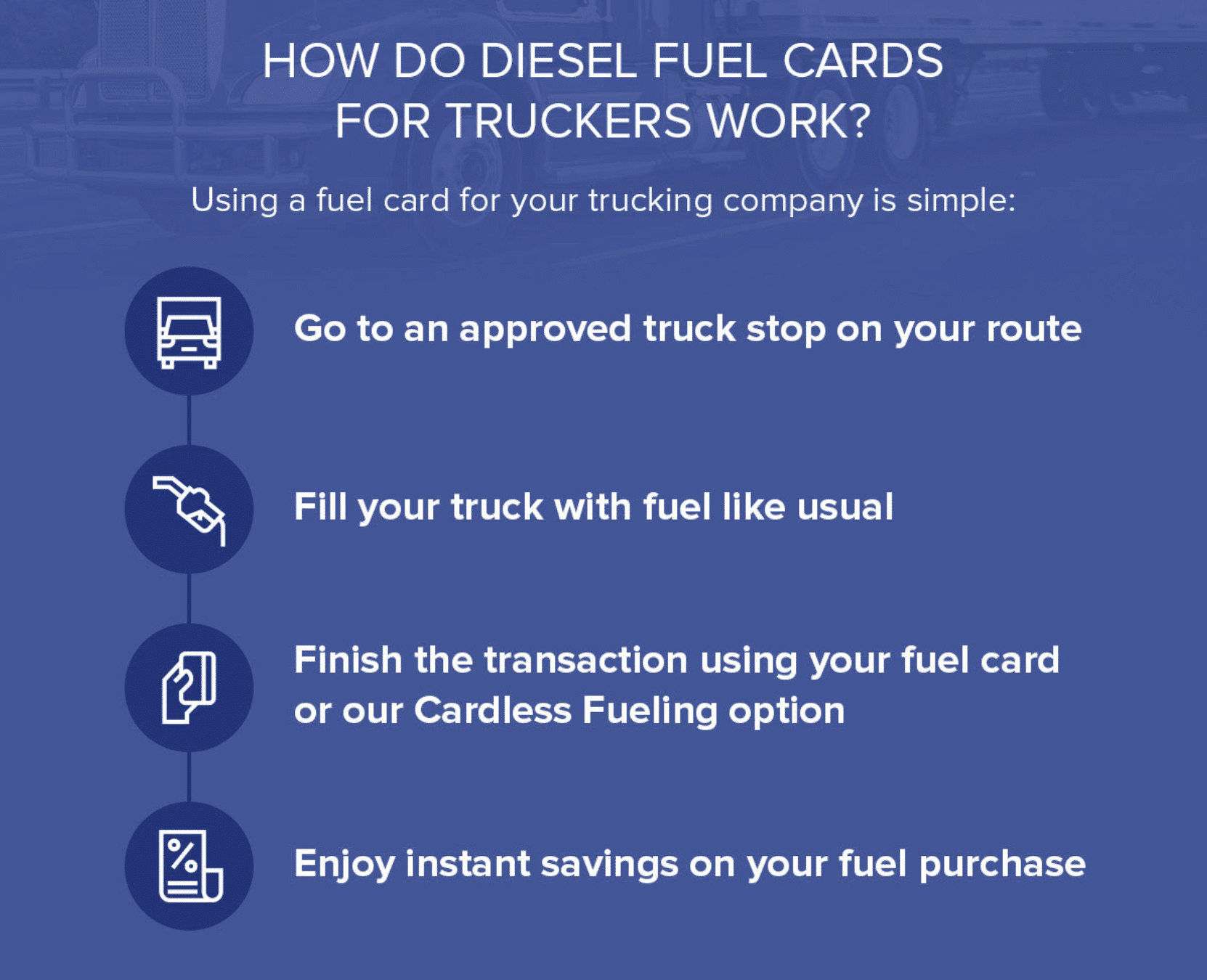

How do diesel fuel cards for truckers work?

Using a fuel card for your trucking company is simple:

1. Go to an in-network truck

stop on your route

3. Enjoy instant savings

on your fuel purchase

2. Use your fuel card to purchase

4. Fill your truck with

fuel like usual

Where Can Fuel Cards

Be Used?

The Apex Fuel Card can be used anywhere EFS or Comdata cards are accepted, which is thousands of truck stops.

The in-network locations are where we offer extra discounts and no transaction fees. At any other location, you will pay the cash price (which is usually 3-5 cents cheaper than the credit price).

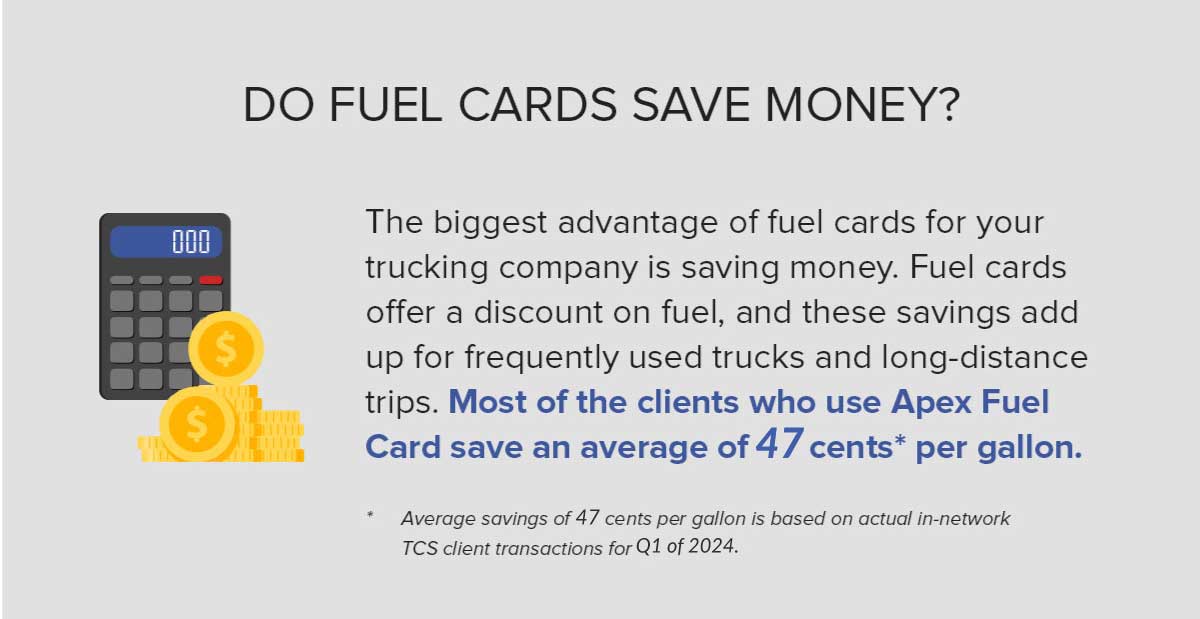

Do Fuel Cards Save Money?

The biggest advantage of fuel cards for your trucking company is saving

money. Fuel cards offer a discount on fuel, and these savings add up for

frequently used trucks and long-distance trips.

Most of the clients who use Apex Fuel Card save an average of 47 cents*

per gallon.

*Average savings of 47 cents per gallon is based an actual in-network TCS client transaction for Q1 of 2024.

Benefits of Fuel Cards for Truckers

Fuel cards bring lots of benefits for trucking companies. Here’s what happens when truck drivers use a fuel card:

- Big savings on every gallon: The best part about fuel cards for trucking companies is they help save money on fuel. Fuel costs a lot for trucking companies, no matter how big or small. Fuel cards give a discount for every gallon, and these savings really add up.

- Easy to use: Fuel cards are simple for truck drivers to use at the pump. They work just like credit cards. With a fuel card, drivers can buy fuel without needing cash or keeping track of receipts.

- Automatic purchase records: When you use fuel cards, there’s no need to save receipts. You can check all the fuel purchases made with your card anytime you want.

- More safety and control: Fuel cards let you control how much you spend on fuel. Drivers can only use them at certain fuel stations. Setting limits on transactions and gallons per day helps stop overspending and prevents theft.

- Simple IFTA reporting: The reports from your fuel card show all the details of your fuel purchases. You can get these reports whenever you need them. These detailed reports make it easier to prepare your IFTA fuel tax reports.

Fuel Discount Calculator

See how much money your trucking company could save with the Apex Fuel Card.

*The Apex Fuel Savings Calculator provides estimated fuel prices and savings, and in no way binds Apex Capital Corp to fuel prices or discounts. The calculator does not provide a final determination of the fuel prices you will pay or the discount you may receive, but is merely an estimation. Fuel prices continually change due to the market, suppliers, and truck stop determinations.

Fuel Discounts Made Easy

The Best Fuel Card for Truckers

The Apex TCS Fuel Card runs on the industry-standard EFS or Comdata fuel card platforms. Choose which program is best for you.

Low Fee Fuel Card

The Apex Fuel Card offers low and fair costs, no matter the size of your fleet. Enjoy no transaction fees on fuel purchases at in-network locations, no set-up, monthly, annual, or membership fees.

Save Money

We pass 100% of our fuel discounts back to our clients with no limits or trial periods, resulting in better prices at the pump when compared to other fuel card companies.

Fuel Partners

Fleet Fuel Management Tools

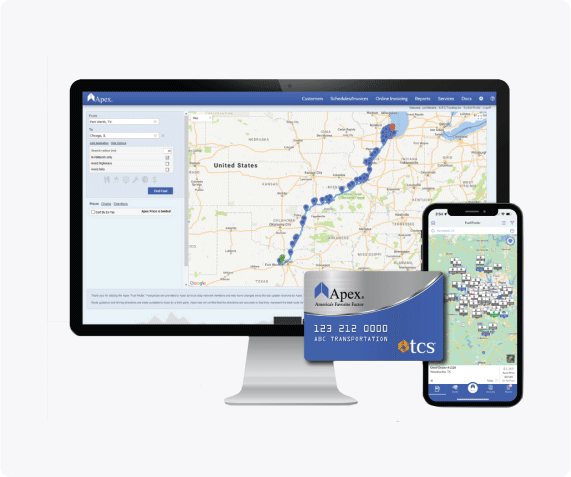

Find Big Fuel Savings:

What good is a fuel card with great fuel discounts if you can’t find the discount locations? We thought of that, too!

The Apex Fuel Finder is a tool that helps you find the best prices on fuel at truck stop locations along your route. Using the Fuel Finder is easy with our Account Management Portal (AMP), so we’ve got you covered from desktop to mobile and everywhere in between.

Fuel Savings Optimization:

The Apex Fuel Finder locates the best fuel prices, and we can also optimize overall fuel purchases with our Fuel Analysis tool. Every Apex client can get a FREE Fuel Analysis anytime. The fuel analysis is a detailed audit of their fuel purchases. It gives Apex clients specific recommendations for their trucking company to help them maximize their fuel savings.

Easy Fuel Reports:

Apex is dedicated to making your most time-consuming tasks easier. We can help you find the best fuel prices, save the most you can on fuel, and provide comprehensive fuel reports. Detailed fuel reports are generated automatically for our clients using our fuel card or whenever they need them. Automatic fuel reports make your quarterly IFTA reports that much easier to file.

Frequently Asked Questions

About Fuel Cards

Start Here To Get Your Fuel Card Today

Apex is dedicated to helping trucking companies save money at the pump. Use the Apex TCS Fuel Card to get an average of 47 cents off per gallon*. No matter your fleet size or distance traveled, your business will save a lot of money on fuel every year.

Sign up for your Apex TCS Fuel Card here!