How To Spot Freight Fraud Before Hauling a Load

Fraud is everywhere. As ecommerce and online money exchanges become even greater aspects of our daily lives, fraudsters will find a way to infiltrate just about all lines of business. In fact, in 2018 consumers lost $1.4 billion to scams, an increase of 38% over 2017.

That includes freight fraud, which is also on the rise. According to FreightWaves, freight fraud costs the industry over $100 million per year. It has become easier for fraudulent brokers to persuade a carrier to haul a load when they have no intention of paying them. That tasks the carriers to regularly look for signs of fraud.

What’s the first line of defense against fraud? A best practice is to make sure the correct carrier’s company name is on the bill of lading (BOL) for payment. It’s also imperative to be vigilant of possible fraud upfront because by the time the factoring company gets the paperwork, the carrier has already taken the load, which could be from a fraudulent broker.

Red Flag Signs of Freight Fraud

At Apex Capital, we want to make sure our factoring clients and all hard-working truckers get paid. So, we put together a list of red flag signs trucking companies can look for as well as Apex tools and services our clients can use to make sure the load they’re hauling is from a legitimate broker.

The importance of credit checks:

- Run a credit check every time before taking a load, even if it’s from a broker you’ve done business with before.

- If you see a note on the credit check advising the carrier to call the broker and verify the load is valid, make that call. This broker could have recently been an identity theft victim.

- For an extra verification step, call the accounts payable (AP) department of the broker to verify it’s a valid load.

- At Apex, credit checks are free for all clients and they could save carriers from taking a load that won’t pay.

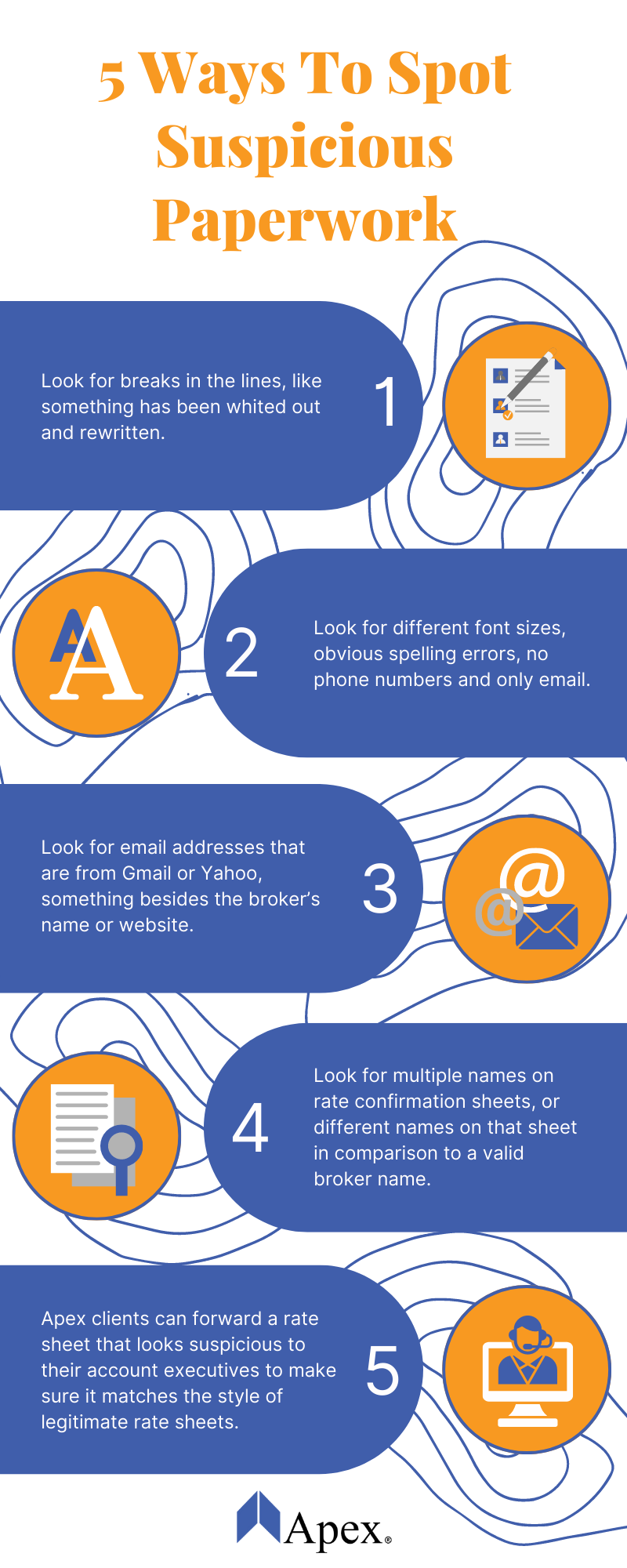

Paperwork that looks suspicious:

- Look for breaks in the lines, like something has been whited out and rewritten.

- Look for different font sizes, obvious spelling errors, no phone numbers and only email.

- Look for email addresses that are from Gmail or Yahoo, something besides the broker’s name or website.

- Look for multiple names on rate confirmation sheets, or different names on that sheet in comparison to a valid broker name.

- Apex clients can forward a rate sheet that looks suspicious to their account executives to make sure it matches the style of legitimate rate sheets.

Other freight fraud warning signs:

- Quoted rates that are way above market value.

- Brokers asking carriers to dispatch their trucks to a shipper prior to getting a rate sheet.

- A pushy broker demanding a bill of lading (BOL).

Apex Can Help Carriers Haul Loads Safely

At Apex, our clients get free, unlimited credit checks 24/7 using our mobile app and client portal. This provides up to date details so they can be confident the load they are about to haul is from a trusted broker. Also, all Apex clients have an account executive that is ready to answer questions about suspicious paperwork so that the carrier doesn’t take a load that could be fraudulent. We always want all carriers to haul safe and get paid for their hard work.

At Apex, we make sure all factoring clients haul safely and get paid for their hard work. We can also be the key to growing your trucking company, managing your cash flow, and offering you a variety of valuable tools, excellent customer service, and back-office support. Ready to become an Apex factoring client? Visit our website or call us at 855-369-2739.